Trade Trends

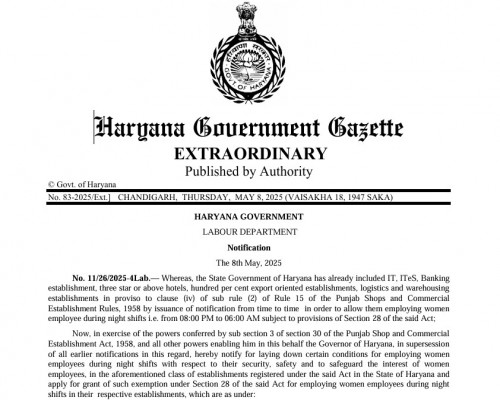

Judicial Updates: Labour Laws

Key Labour Law Insights

Jan 13 2026 10:40

Nov 22 2025 06:59

Key Labour Law Insights

Nov 21 2025 09:41

Key Labour Law Insights

Judicial Insights

Editor's Eye

Nov 22 2025 06:55

The Jewar Miracle — A Testament to New India’s Vision

Nov 21 2025 09:33

Narendra Modi at 75 – Leadership that Transformed a Nation’s Destiny

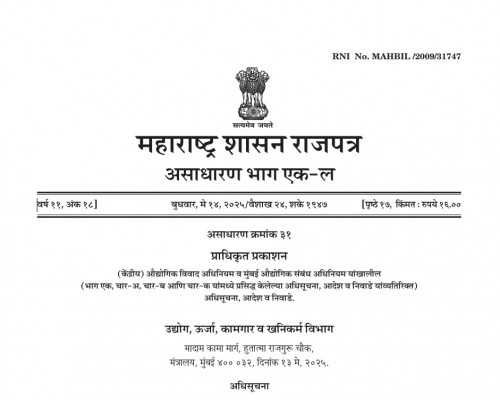

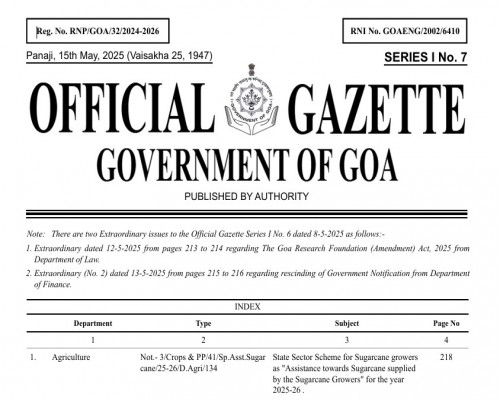

Official Orders Hub

Insightful Exchanges

Green Pulse

Nov 22 2025 10:47

Delhi Emerges as the World’s Most Polluted City

Power Dynamics

Pan-Northeast political realignment underway: A new party takes shape

Nov 22 2025 11:16

Nov 22 2025 06:17

India Will Not Become a Superpower Like Others: Bhagwat

Current Lens

Pilot Association Urges Suspension of Air India’s Dreamliner Flights

Nov 22 2025 11:09

Nov 22 2025 11:08

Protecting Children’s Rights: Even a Harsh Look Can Be Considered Abuse

Nov 22 2025 11:06

Satellite-Based Toll Collection System Deferred Amid Privacy Concerns

Truth Unveiled

Nov 22 2025 10:10

Theft of Over a Thousand Restaurant Chairs Uncovered in Spain

Nov 22 2025 10:06

Jeweler Embeds Two-Carat Diamond in Artificial Eye After Losing Vision

Vital Wellbeing

Sound Sleep Ahead: ‘Sleep Lab’ to Offer New Hope for Insomnia Patients

Nov 22 2025 10:33

Nov 22 2025 10:31

Himalayan Plant ‘Piruli’ Shows Promise in Treating Colon Cancer

Nov 22 2025 10:26

Why Is Cancer Increasing Among Younger People?

Beyond Borders

Inner Journey

Wanderlust Window

One in Every Thirty Air Travelers in India Now Flies from Uttar Pradesh

Nov 22 2025 09:47

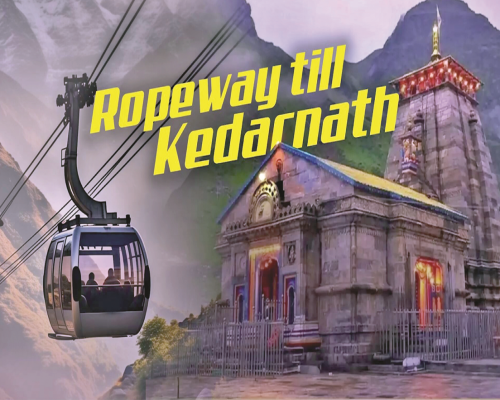

Adani Group Wins Tender for 13 km Kedarnath Ropeway Project

Nov 21 2025 11:55